Link to article

When I was interviewing for jobs, I was always fascinated what the interviewer would be like.

- Would I like them?

- Would I get along with them?

- How would they run the interview?

- What sort of questions would they ask?

I’ve met many different types of interviewers over the years. They do come in all shapes and sizes with the personalities to match too.

Types of Interviewers

I’ve met:

- Timid interviewers

- Confident interviewers

- Arrogant interviewers

- Aggressive interviewers

- Interviewers who wouldn’t listen

- Interviewers who only asked a few questions

I’ve met quite a few.

And yet somehow we are fearful of them. They are in control of a process. A process that will either open a door to a job or have it closed firmly in our faces.

We often spend a lot of time thinking and talking about what we as interviewee should or shouldn’t do. Seldom do we think about an interviewer.

Interviewers – 10 Things

There are 10 things you need to know about interviewers:

1. Training – most interviewers have never been formally trained. Instead they’ve either watched other people conduct interviews or read a book or article.

2. CV/Resume – there’s a good chance that they’ve not read or fully read your CV/Resume ahead of the interview.

I know, all that work you put into it. But they are busy and are often running late between meetings, or just can’t be bothered.

Yes interviewers ‘wing it’ too. You’ll need to showcase your skills, experience and knowledge.

3. First Impressions – yes, no matter what someone says, they are judging you from moment one. From that moment on they are either trying to reinforce that opinion or disprove it.

4. Best Person – as interviewers we’re looking for the right person to fill the job.

Interviewers hope that each candidate they see will be the one.

It’s up to you as the interviewee to show that you’re the best person for the job. If you leave the interviewer with questions, there’s a good chance they’ll wait to see who else comes along.

5. Questions – don’t expect an interviewer to come up with anything different to that of an interviewer in another company.

Most use exactly the same questions as any other interviewer. Therefore you can do a lot of preparation in advance. Here’s a link to the 21 Most Common Interview Questions.

6. Unsure – I know this sounds odd, but I’ve experienced interviewers who don’t know what they want in a candidate. They say they know, but when pushed they don’t.

7. Preparation – interviewers like to see that you’ve come prepared.

That you’re ready for the interview. Ready to show that you’re the best candidate. Ready to show that you know about them and their organization.

8. Bad Hires – it happens. An interview seems to go well, but then when the person starts it doesn’t go according to plan.

That happened to me with Paula. She came across well in the interview only for it to start to fall apart from day 1.

This then makes an interviewer even more cautious about making the right hire next time.

We all hate making a bad hire. It costs not only money but all that time spent interviewing has gone to waste.

9. Perception – it all comes down to how an interviewer perceives you.

You can have multiple interviewers in the room and they can all come out with different impressions of you. And that’s when they’ve asked the same questions and listened to the same answers.

So make sure you address each and every interviewer. Validate that you’ve answered their questions and ask whether they need any more information.

10. Rejection – most interviewers don’t like giving feedback.

They’ll find some way of getting someone else to do it for them. So don’t be surprised if you don’t get any feedback in an interview.

I used to be like that.

I would give feedback to the HR contact or the recruitment agent. I remember on one occasion giving feedback to the recruitment agent only for them to say ‘Well, I can’t tell them that’. I said ‘Why not?’ He said ‘It’s not my job to provide feedback, only to get them a job’.

What chance would the candidate have if no one gave them feedback?

It was a valuable lesson for me. Since that day I’ve given feedback to every interviewee. Sometimes when they don’t want it. But without it how can they expect to improve.

So next time you’re heading into an interview, take a moment and think about the interviewer.

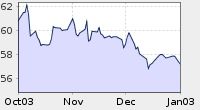

0.72 1.35%

0.72 1.35%