9 Signs You Should Run Away From That Job Offer

Some companies will do anything to get you to work for them. Here’s how to spot a bad situation before it’s too late.

Last year, I was asked to predict a hiring trend for 2015. My prediction? Employers would start to play dirty in order to get people to take jobs.

In spite of the fact that 89 percent of professionals want a new job, and 26 percent feel they are underemployed, companies are claiming there’s a talent shortage right now. How can that be? It has to do with the Age Curve. As the largest population in the workforce (Baby Boomers) retires at a rapid rate, there aren’t enough Gen Xers to replace them. The result is companies have to tap into the youngest (and least experienced) population, a.k.a. Millennials. That’s why there is so much talk and frustration around generational differences. The Baby Boomers arefrustrated they can’t fill their jobs with workers who are just like them.

As a result of the perceived talent shortage, executive teams are putting pressure on recruiting departments to get workers in the door. One way they do this is by building elaborate marketing programs designed to capture the attention of talent. It’s called employment branding, and it’s how companies lure you to check out their job postings. However, as more and more companies use employment branding to vie for your attention, the recruiting space gets noisy. Recruiters then have to come up with even more ways to get you to take the job, often leading them down the path of “little white lies” to get you to say “yes” to the offer.

As a job seeker, you need to recognize a bad employer before you accept the job. Why? Once there, you’ll need to stay put for a while so you don’t look like a job hopper. One or two short-term gigs due to poor employer choices, and you’ll be seen as the one with the problem.

Here are nine signs the job opportunity isn’t all it’s cracked up to be:

1. They can’t stop telling you how much “fun” they have.

If everyone keeps saying, “We work really hard, but we have so much fun,” you have to ask yourself, “How’s that possible? What’s their definition of fun.” More important, why are they pushing it so hard? Work is about feeling a sense of accomplishment. We’re satisfied when we do work that makes an impact. Fun is nice, but it isn’t what gets the job done. Be careful of the hype — it’s usually there to mask reality.

2. They have no problem with your salary requirements.

If you’re pricing yourself at the higher end of your skill set, then good companies willpush back and want to negotiate with you. Any company that has no problem with your ideal salary is trying to fix an internal problem by hiring people they can hold hostage with salary. Think about it: If you’re getting paid much higher than you’ve ever been paid before, AND it’s higher than what you can make anywhere else, the company knows it will be difficult for you to leave. Money is the carrot. Be careful before you take hazard pay!

3. They don’t let you talk to co-workers.

You should ask to speak to as many co-workers as you can before accepting an offer. Why? It’s important to connect with your peers so you feel like you can establish relationships quickly and get up-to-speed fast. When they don’t want you talking to co-workers, they’re hiding something. Likely, they’re afraid the co-workers will tell you to run for the hills!

4. They can’t explain the unaddressed bad reviews on Glassdoor.

Every job seeker should visit Glassdoor.com to see the anonymous reviews of the company. If the ratings are consistently poor (ignoring the one random angry ex-employee), then you should ask about the themes you saw in the reviews. Politely inquire by saying, “I know no employer is perfect. I like you all very much. I checked you out on Glassdoor, and there were a few concerns around ___. Can we talk about those and the executive team’s thoughts on them? I like to hear both sides of a situation.” By giving them a chance to explain, you can see if A) they are aware they have bad ratings, B) if they have a plan to improve. If they play dumb or start the blame game by throwing ex-employees under the bus, you know they’ve got problems.

5. While researching employees on LinkedIn, you see a large percentage of them have left in the past year.

Turnover is a sign of a bad employer. If the company has fifty employees, but you’ve found twenty former employees who left in the past year on LinkedIn, that’s almost a 50 percent turnover rate. Annual turnover in good companies is usually less than 20 percent. High turnover is a sign of a company with internal issues.

6. They don’t have a clear answer on why the job is open.

The ideal answer to why the job is open is the person in the role is getting promoted. Or, the company is growing so much they need to add to staff. But if they can’t explain what happened to the last person, or they imply they’ve had a tough time finding the right candidate, you should be concerned.

7. They don’t let you talk to the manager, or they try to prep you about the manager and his “eccentric” style.

If the manager always seems to be unavailable to interview, or they feel the need to warn you about the manager’s style, then multiply what you see in the interview times ten and that’s what the manager will be like to work for. Never, ever take a job without meeting the manager and making sure you’re comfortable communicating with him or her. This is the person who can fire you. You must feel capable of working with this person. Hence, feeling confident in your ability to collaborate successfully with the manager is key!

8. Nobody makes eye contact with you at the interview.

As you walk through the halls, if nobody is smiling or looking up to make eye contact, you have to ask yourself, “Why are they so serious?” And, more important, “What are they afraid of?”

9. People keep telling you it takes a “special” kind of person to succeed in the work environment.

This is code for, “It’s difficult to work here, so you better have thick skin and be able to deal with the stress and drama.” Overly competitive cultures usually use this word. Why? When you hire a group of people who all think they are “special,” you get a bunch of self-centered people who are worried about their career first, and will do anything to make sure they’re seen as more special than the rest.

To be honest, I could give you a lot more. But, I’m going to leave that to my fellow readers and invite them to post additional warning signs in the comment section below.

The best advice I can give to job seekers is to remember you’re a business-of-one selling services to an employer. If you want a win-win situation, you need to vet the employer and make sure you know what you’re getting into. Don’t get fooled! Do your homework, be informed, and seek an outside party to help you validate the job offer if you can. There are no perfect employers — and HR has a lot they don’t want to reveal to you. But there are definitely some employers that are better than others. If you want to work with the best, you need to do your best to seek them out.

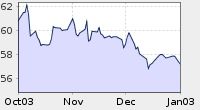

2.74 5.96%

2.74 5.96%