The Worst US Drilling Drops For 2016 Have Now Passed

This downturn is about 67 weeks old. In only 12 of those 67 weeks has the US onshore oil rig count registered an increase. Last week was one of those with the onshore oil rig count leaning into the wind and rising by one unit. This was the first weekly increase seen since December 2015.

While we try not to read too much into the weekly changes (rig moves and other factors can add noise), it does appear that largest weekly declines of the year are now behind us. The recent rally in oil prices doesn’t hurt.

In early-2015, the drilling collapse resembled a massive bell curve spanning January to May. This makes sense as new E&P budgets take effect in the first quarter. Over the 2015 bell curve decline, the US onshore oil rig count came down 815 rigs, an average of -37 per week with the biggest weekly loss seen in late-January (-89).

After that, there was a bit of relief with some weekly increases in the summer followed by a slower trickle in the fall (a pattern that followed oil prices up and then back down).

From January to March this year, we’ve again seen the bell curve shape collapse in the rig count. While a gradual drift lower may continue, we believe last week’s uptick closed out the worst period of the year for rig count pain (a similar uptick book-ended the big decline last year).

Until this week, the US onshore oil rig count had fallen each and every week of the year with the decline totaling 153 rigs, an average of -14 per week (biggest drop this time was -32 the first week of February). Coming into 2016, there were only 516 US onshore oil rigs working vs. the 1,443 rigs entering last year. With just 363 US onshore oil rigs still active today, there just isn’t much room left to fall…

Weekly North American Rig Count Statistics

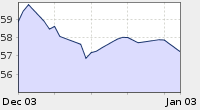

Last week, the total US land rig count fell 4 rigs to 446. The North America rig count fell 33 units last week. With WTI rallying some 50% over the past 4-5 weeks, the rig count could begin to find some stability, perhaps still drifting lower but not collapsing like it was earlier this year.

The Independent E&Ps are cutting capex even more than we expected, and spending declines this year will likely be 40-50% below 2015 in the aggregate. We believe current drilling levels are not sustainable and will translate into a meaningful production response, which we believe will become clear by 2017.

In Canada, the rig count fell 29 rigs to 69 for the week.

A regional summary of rig counts by key basins is below. With 152 rigs working, the Permian is still the most active basin, and it was flat on the week. The Eagle Ford, with 45 rigs running, is the second most active basin, and it was up 2 last week. With 31 rigs running, activity in the Bakken was down 1 rig last week.

1.74 4.33%

1.74 4.33%