Originally posted by CareerBuilder. The first one is pretty cool for me!

Originally posted by CareerBuilder. The first one is pretty cool for me!

Please SHARE with your network on LI, Facebook and Twitter.

Apply online at http://www.cfstaffing.com – Houston office or email me at dlemaire@cfstaffing.com

AP/AR Manager:

Sr. Staff Accountant:

Financial Controller: (Catholic Charities)

Controller – Grants Billing:

SEC guru with XBRL tagging experience

Sr. Payroll Processor

QuickBooks Accountant

It’s the one that was always coming and yet the question that invariably causes the most interview headaches. As self-deprecating as we may be in our daily lives, it is surprising how uncomfo…

Source: Handling the impossible question: what are your weaknesses?

Your cover letter can be the introduction to you that makes a recruiter’s eyes sparkle with interest or glaze over with indifference. So it’s worth thinking about how you can use it to …

Overview:

Basic/Minimum Qualifications:

Desired Qualifications:

Benefits

Highlights!

– 90K to 105K annually

– High visibility to upper management

– International exposure

– Stable Company (70+ years of existence)

– This role will be a succession plan for the SEC manager

– 4%+ match on 401K

– Stock options possible once market turns

Requirements:

– Accounting degree

– SEC reporting or Oilfield services experience

– Major ERP experience

– Problem solving mentality

– 5-8 yrs experience

Job details:

Apply online at: http://www.cfstaffing.com

JOB DUTIES

Article originally published on SharpHeels

For many of us, college was our first experience as adults. We lived away from home and took care of our own schoolwork, schedules, and responsibilities. College is a time of constant transition and learning, but there is one thing that students might not learn during their college career: how to ace the employment interview.

While many college campuses across the country offer classes focused on career preparedness and interviewing strategies, these courses are usually not required to graduate. Knowing what’s really important when it comes to interviewing will help you successfully transition from student to working professional. Here are three key tips:

Reading a company’s mission statement and scanning a few pages on its website won’t necessarily arm you with the information you’ll need to ace an interview. Instead, spend your time learning about the values that are important to the company. Make sure you read through employee bios to get a feel for who the staff is, and take note of any similarities in your own personality or of anything that makes you feel as though you would be a good asset to the team. These are the things you should know before going to the interview.

Additionally, educate yourself on the company’s culture. Employees who fit in with the company’s culture make a work environment successful, so employers look for applicants who share the company’s vision, values, and norms. Show your interviewers that their beliefs and values are important to you by highlighting aspects of your personality and work ethic that align with them. This will differentiate you from other candidates vying for the same position, and help your interviewers to visualize you working in the office alongside them.

It is not recommended to show up for an interview empty-handed, but the traditional notion of bringing paper and pen to take notes is outdated and not useful anymore. You need to portray yourself as a professional, not a student, and engage with your interviewer rather than sit and listen while taking notes. Bring things that show your talents and skills; for example, class projects that show potential employers what you’re capable of.

Keep your outfit polished and professional. Don’t wear anything that is too tight or revealing. Many companies have adopted casual dress codes, so it can be difficult to decide what to wear, but something between business casual and business professional is always a safe bet. Most importantly, make sure that you are comfortable in what you are wearing.

The first key to comfort is wearing shoes you can easily walk in. Companies in metropolitan areas often do not have parking that leads to the front door. You don’t want to show up to an interview with blisters forming on your feet because you wore shoes that weren’t easy to walk in.

It’s also a good idea to opt for pants rather than a skirt, because you don’t know what kind of environment you’ll be interviewing in. Having a wardrobe that works in a variety of settings and that you are comfortable and self-assured in will eliminate some of your pre-interview stress.

While confidence is the key to making a good impression, over-exaggerating your capabilities is not a good tactic. In the moment, you may feel like playing up your skills and overstating your strengths might increase your chances of landing the job, but if you do, in fact, land the job, your employer will expect you to deliver on whatever you promised in your interview. If you claimed to know something that you don’t actually know, it won’t matter how poised or personable you were in the interview, or how much you connected with your interviewers; your credibility with the person who hired you and the people you are working with will be ruined. This kind of mistrust can possibly lead to your termination from the position.

It’s important to remember that someone running a business will appreciate your honesty when it comes to your skills. As long as you can show a potential employer that you are aware of weak spots and are actively working to improve, you should not be afraid of being truthful. Your interviewer will appreciate you even more for your candor, and it may position you as an even better fit for the company than he or she may have originally thought. Stay confident and be honest in how you represent yourself and your abilities.

The more you interview, the more things you will learn and the better able you will be to develop your own unique style, but these tips are a good starting point to help you showcase your personality, honesty, and work ethic. Don’t be intimidated by the transition from student to working professional. Embrace it, and remember that you have skills and talents to offer. Let those shine through and you’ll find success.

Have questions about interviewing, or your own tips for new grads? We want to hear them! Comment below or contact one of our expert recruiters today! Find the closest CFS location to you here.

Read the original article published on SharpHeels.

Posted by Creative Financial Staffing at 9:51 AM No comments:

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Crude Oil and Commodity Prices

January, Monday 16 2017 – 07:58:10

|

|

||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

The Houston Purchasing Managers Index (PMI), a short-term leading indicator for regional production, registered 50.7 in December, signaling economic expansion in metro Houston for the third straight month, according to the latest report from the Institute for Supply Management-Houston (ISM-Houston).

Click to access Purchasing_Managers_Index.pdf

Remember, you only have one chance to make a great first impression! Meredith Woods, Staffing Manager of CFS Bethesda, agrees that it’s important to introduce yourself with confidence. Whether you are meeting the CEO or the receptionist, greet everyone with a smile and respect. Also, your colleagues will take note of the effort you put into meeting them, so be sure to put yourself out there.

Don’t forget to ask questions

Landing your first professional job out of college is a big deal. Although you may feel you know everything, navigating the real world isn’t as easy as navigating a college campus. Patrick Senn, Managing Director of CFS Minneapolis, says “often times we feel like asking for help or not immediately knowing the right answer to something can show weakness, but it is critical to ask for help.” You’re not supposed to know everything right away, and asking questions shows your eagerness to learn.

Take chances

You were chosen out of numerous applicants to do this job because someone believed in you. Now you have to take a chance on yourself and step outside of your comfort zone. Step up and tackle that new project. Volunteer to lead a new marketing strategy. Whatever it is, even if it scares you, look at it as a chance to grow and accelerate your career.

Accept feedback

The first 90 days at a new job generally serve as an evaluation period. When working on your first big project or submitting that first proposal, you are likely to receive some feedback. John Jameson, Executive Recruiter of CFS Chicago, advises that you “view all constructive feedback as criticism, then learn to recognize the true value of it.”

When a manager advises you of a mistake you’ve made, it’s easy to be taken aback or even offended, but you need to remember that mistakes happen. The key is to utilize the valuable feedback and use it to grow. Your manager’s knowledge and experience is an amazing resource.

Never burn bridges

Through the course of your career, you’ll meet a lot of people at the office, work functions, networking events, and more. These connections will prove useful when you want to transition out of your current role. “It is very rare now for someone to start their career and then retire from the same organization. With this being said, your reputation/personal brand is very important and you don’t want that tarnished by burning bridges with your current employer,” explains Senn.

Say “Thank You”

Senn also adds that there is a lot that goes into training/developing/mentoring a new employee, and sometimes you need to take a step back to realize that you should be saying “thank you”. Your manager is giving up their time to make an investment in you and your future, and saying “thank you” is the easiest way to show your gratitude.

Prepare your own lunch

It’s easy to think that you’ll be able to eat out more often when you start your career. Think again. Being that this is your first “real” job, you should still maintain a budget. This isn’t to say that you should skip the lunch outings with coworkers, but instead just do them sparingly. Your health, your waistline, and your wallet will thank you.

What were some of the lessons you learned when you started your career? We want to hear them! Leave us your story in the comments below.

Looking for a job? Contact a CFS recruiter today and we’ll help you with your search! Find the closes CFS location to you here.

Posted by Creative Financial Staffing at 4:33 PM No comments:

Email ThisBlogThis!Share to TwitterShare to FacebookShare to Pinterest

Labels: Career Development

Crude Oil and Commodity Prices

January, Monday 9 2017 – 09:10:08

|

|

||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

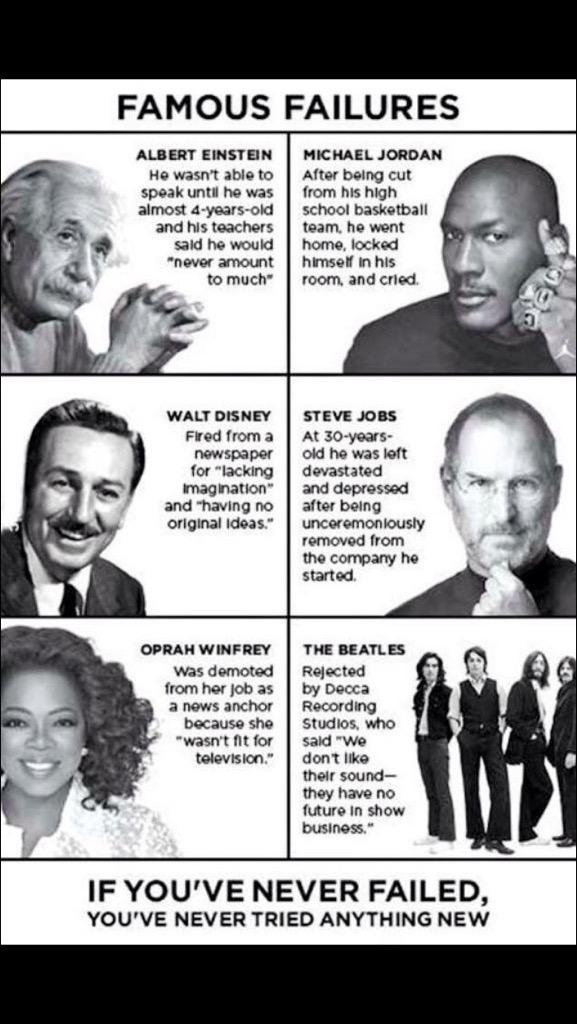

This is the way I feel!

Are you passionate about the non profit community? Are you eager to learn? Do you love to ask questions? Do you want to learn about the operations of a non profit? Then you may be the perfect fit for this Non Profit Staff Accountant role!

Overview

Requirements

Benefits

Downtown Houston

Essential Duties and Responsibilities

Knowledge and Skills

Newly acquired company located in Phoenix, AZ. 100% private equity owned. Looking for experienced CFO with M&A, previous private equity, and manufacturing experience. 40M dollar company.

Base, Bonus & Equity!

Email dlemaire@cfstaffing.com

Responsibilities:

Report to the CEO as well as the Board of Directors on financial and strategic matters. Assist the CEO and Board in evaluating and implementing strategic initiatives. Provide the Board with annual budgets and monthly reporting packages.Manage relations with financial institutions. The company will finance working capital primarily with asset-backed bank lines. Candidate should have substantial experience interfacing with banks and manage bank relations.

Manage relations with key suppliers seeking to control raw material costs. Also, work with trucking vendors to maximize on-time delivery as well as control delivery costs.

Report to the CEO with regards to various operational improvements and assist the CEO in tracking the performance of these initiatives in monthly reports. Report to the President (Head of Sales) on customer-facing initiatives and track performance through monthly reports.

Work with private equity firm in diligence of acquisition opportunities and oversee the consolidation of those opportunities post-close

Eventually, oversee 3-4 regional controllers throughout the country that manage different regional P&L’s and standardize reporting amongst each region

Oversee Information Technology, Procurement, and Human Resources

CFO would be viewed as a critical member of the senior management team and would participate in the equity of the Company through equity warrants linked to performance and shareholder value. Annual cash compensation would include base salary + performance-based bonus. Salary range can adjust commensurate with background and experience of the candidate.

Preferred Skill Set:

Prior experience (10+ years) as CFO of a lower-mid market company with $50MM to $300MM of revenue where the CFO had to take a hands-on/entrepreneurial approach and had oversight of all financial areas (accounting, treasury, monthly KPI reporting, audit, strategy, bank loan covenant reporting and managing bank relationship)

Prior experience in the manufacturing space with a cost accounting background and experience implementing operational improvements regarding production capacity and production efficiency. Experience managing trucking/delivery logistics also preferred.

Prior experience dealing with private equity or other financial sponsor-backed companies that require the CFO to prepare budgets, build financial models, and prepare detailed monthly board reporting packages.

Experience dealing with banks and other financial institutions with regards to loan logistics, loan documentation and letters of credit.

Must be able to manage a 3-5 person accounting team and develop daily and monthly reporting procedures.