Author: Dianedelgadolemaire

I’m an Accountant!

Happy Friday!

Accounting Supervisor – Downtown – dlemaire@cfstaffing.com

MUST have Dynamics

Overview: Manage team of 2 and Month End Close Process

- Manage the accurate and timely processing of accounts payable, petty cash, employee expense reports and wire transfers.

- Prepare quarterly and annual billing

- Monitor bank balances, reconcile accounts monthly.

- Prepare journal entries to reflect payroll and benefits, revenue recognition, and various GL activity.

- Perform monthly General Ledger closing procedures and GL Account Reconciliations.

Requirements:

- Accounting Degree

- MS Dynamics

Property Accountant – Downtown – dlemaire@cfstaffing.com

Overview:

- Maintain the general ledger, financial reporting, budgeting and forecasting for assigned properties

- Monthly journal entries, income and expense accruals, job costing,

- Accounts payable, accounts receivable, cash receipts, bank reconciliations and lease administration

- Timely preparation of periodic financial packages, forecasts & budgets including analyses and supporting schedules of all balance sheet and income statement accounts.

Qualifications:

• 5+ years of extensive exposure to commercial real estate accounting.

• Bachelors degree in accounting or finance, professional accounting designation preferred.

Key Economic Indicator – Purchasing Managers Index (PMI) Via Greater Houston Partnership

The Houston Purchasing Managers Index (PMI), a short-term leading indicator for regional production, registered 43.8 in July, up slightly from 43.7 in June, according to the latest report from the Institute for Supply Management-Houston (ISM-Houston). With the July reading, the PMI has signaled economic contraction in Houston for 19 consecutive months. To access the full report, click here.

What’s Your SUPERPOWER?

Updated List of Accounting & Finance Job Openings – dlemaire@cfstaffing.com

Here is what we are working on this week! dlemaire@cfstaffing.com

- Small company Accounting Supervisor

- Senior Accounting Analyst (public accounting required)

- Construction Staff Accountant

- JIB Senior Accountant

- Director FP&A with CFO track

- Tax Manager (big 4 needed)

- Tax Senior – Big 4 required

- Staff Accountant

- Senior Property Accountant

- Senior SEC Accountant

- Staff SEC Accountant, CPA

- Reinsurance Analyst

- AP Manager

- Senior IT Auditor

- Internal Auditor – 40% travel

- Internal Auditor – 60% travel

- Internal Auditor – 30% travel

- Staff Tax Accountant – Industry

- Senior Tax Accountant – ULTRA high net wealth clients

- Senior Insurance Accountant

- Payroll Admin

- AP Specialist

- AR Specialist

- Division Assistant Controller

- Audit Senior public accounting

Small Company Accounting Supervisor – West Houston – dlemaire@cfstaffing.com

Overview:

- Supervise AP & Staff Accountant

- Cash & Bank Management

- Manage Month End Close

- Review Financial Statements

- Oversee monthly bank reconciliations

- Review AP and AR coding

- Assist in year end audits

Requirements:

- Accounting Degree

- 1 plus years of supervisory experience

- 4 to 8 years of General Accounting

- Excel and major ERP

Happy Monday!

This map shows what $100 is really worth in your state via http://www.businessinsider.com/

Your dollars go further in some states than others.

The Tax Foundation released a map showing the relative value of $100 in every state compared with the national average using the data from the Bureau of Economic Analysis.

In expensive states like New York, you can afford comparatively less than average; in less expensive states like Mississippi, you can buy relatively more.

“Regional price differences are strikingly large; real purchasing power is 36 percent greater in Mississippi than it is in the District of Columbia,” the Tax Foundation wrote.

“In other words, by this measure, if you have $50,000 in after-tax income in Mississippi, you would have to have after-tax earnings of $68,000 in the District of Columbia just to afford the same overall standard of living.”

Here’s the map:

The states with the largest relative value of $100 were:

- Mississippi ($115.34)

- Arkansas ($114.29)

- Alabama ($113.90)

- South Dakota ($113.64)

- West Virginia ($112.49)

The states with the smallest relative value of $100 were:

- District of Columbia ($84.67)

- Hawaii ($85.62)

- New York ($86.43)

- New Jersey ($87.34)

- California ($88.97)

Friday Humor!

July Jobs Report 2016

I know it doesn’t feel like this in Houston, but here it is:

http://www.bls.gov/news.release/pdf/empsit.pdf

Waiting for the oil comeback:

What is the price of Oil today? 8/4/2016

Crude Oil and Commodity Prices

August, Thursday 4 2016 – 07:41:51

|

|

||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||

Handling rejection like a pro viahttp://cfstaffing.blogspot.com/

It’s the call you’ve been anxiously awaiting, but unfortunately it’s not the outcome you had hoped for: you didn’t get the job. You might feel defeated or even a bit lost, but remember that this can happen to the best of us. Rejection is an unavoidable part of the job search process, but it’s something you can learn from. Our recruiters have shared their expert advice on handling job search rejection like a pro.

Be Professional

You shouldn’t take things personally. Nicole Hicks, Staffing Manager of CFS Seattle, reminds us that the company is not rejecting you as a person. Your skills simply don’t match up with what the company needs right now, but not necessarily what they’ll need down the road. This is why it’s crucial to always thank your interviewer and maintain a professional relationship. You never know what opportunities may arise in the future.

Stay Positive

It may be cliché but it still remains true. There is a reason we end up where we do and it’s important to remember that. Ron Ramey, Executive Recruiter of CFS Columbus, explains that more often than not it will come down to two people, and in the end one person simply has a little more experience than the other. In this scenario, Ramey says it’s important to focus on the positives takeaways from the interview process. What did you do well? How did you present yourself? Were your answers relevant and concise? Utilize this experience to your advantage and form a game plan for your next interview. You don’t want to overthink a job that “wasn’t meant to be”.

Ask for Feedback

Self-evaluation is the first step to improvement, but honest feedback from someone else is especially helpful! If you have the opportunity to ask your interviewer for feedback, then you should take it. Not only will you gain an outsiders perspective, but it will make you a stronger candidate in the future. You can utilize their response of why you were rejected and put it to good use.

Don’t Dwell on It

You won’t be able to move on if you constantly think about it. In addition, you don’t want to speak about any of your past rejections in an interview and give a prospective employer reason to think you’re not a desirable candidate. As Hicks says, when you go on a first date it’s not common practice to speak about an ex, and the same idea applies for a job interview.

Always remember that the interview process will be filled with trial and error. It takes time to find the perfect job. That’s why it’s called a job hunt! In order to succeed you need to get yourself out there and not be afraid of rejection- the right job for you will come along.

Looking for your next job? We’re here to help!

Find the closest location to you here.

Tax Accountant – NW Houston – dlemaire@cfstaffing.com

Are you tired of commuting into Houston? Do you live on the northwest side of town? Would you like to work for a family friendly CPA firm?

Well don’t stop now. Email me at dlemaire@cfstaffing.com and lets discuss this mid size firm that offers a family friendly atmosphere and that would cut your commute in more than half!!!!!

Director FP&A – CFO TRACK – dlemaire@cfstaffing.com

This position is a key member of the finance leadership team. They are responsible for making recommendations to enhance financial policies and procedures in addition to providing strategic leadership and advice to the overall finance team.

- Ensure timely and accurate preparation and analysis of the annual budget, forecasts, and financial data on both a regular as well as ad hoc basis.

- Manage a team of financial analysts to ensure data integrity and reliable reporting and analytics.

- Build collaborative relationships with the partnership, executive management, and internal departments.

- Act as a consultant to communicate in-depth, independent analysis to management so they understand the financial impact of business decisions so they can act accordingly.

- Organize and direct the preparation of analysis and forecasts for senior management in internal operational reviews and strategic planning

- Measuring and monitor performance against budgets and targets.

- Profitability analysis

- Identifying target areas for improvement based on key business metrics

- Develop and implement procedures and systems to improve the budget preparation process to ensure the budget and other financial models are accurate, complete and aligned

- Advise and assist senior management in the implementation of business strategies.

- Analyzing current and past trends in key performance indicators including all areas of revenue, cost of sales, expenses and capital expenditures

Required:

- MBA

- 10 plus years of financial analysis, budgeting and process improvement.

- Advanced written, verbal and interpersonal skills

SEC Accountant – North Houston

Responsibilities:

SEC Reporting

- 10-K, 10-Q and 8-K preparation, roll forward word document, maintain document support binder

- Prepare supporting schedules, checking for reasonableness, consistency and errors

- Prepare quarterly analytics to facilitate MD&A

- Assist with the preparation of GAAP and SEC quarterly checklists

- Assist with information requests for internal and external audits

- Assist with the preparation of accounting memos as necessary

- Maintain the financial reporting process for compliance with the Sarbanes-Oxley Act

- Respond to lender due diligence requests

- Assist with the preparation of financial slides for CFO presentations

- Assist with the preparation of the Company’s goodwill impairment analysis

- Assist in the review of quarterly reports prepared for the Company’s lender

Qualifications:

- 3+ years of financial reporting experience in a public accounting – or big four public company financial reporting experience.BS in Accounting/Finance. CPA and/or MBA preferred.

- Accounting Degree; MBA and CPA a plus

CareerNews Do These 3 Things and Build a Successful Career Written By Leah Arnold-Smeets

There’s no recipe for success. What works for your career might not work for your neighbor’s, and vice versa. But, there are a few things that most successful people do, regardless of their industry or goals, that help them achieve their dreams.

(Photo Credit: Death to Stock Photo)

1. Never stop learning and growing.

The best way to continuously advance your career is to always be learning and growing as a professional. For example, if you’re acivil engineer looking to boost your career and earnings potential, then you may want to consider obtaining your Professional Engineer (PE) license or another certification to distinguish yourself in your field. Likewise, if you work as a project manager, then the next step would be to obtain your Project Management Professional (PMP) certification to advance your skills and knowledge.

You can also advance your chances at career success by keeping up-to-date with news and influencers in your given industry (and the world, for that matter). The point is, the people who get promoted are the ones who are aggressive and proactive about honing their skills and furthering their education.

2. Maintain an open network.

“According to multiple, peer-reviewed studies, simply being in an open network instead of a closed one is the best predictor of career success,” says best-selling author and entrepreneur Michael Simmons in his post on Medium. Simmons concluded this after interviewing many of the world’s top network scientists on his “quest to understand how networks create competitive advantage in business and careers.”

In order to understand what an “open network” is, it’s important to understand what it is not. Simmons says, “Most people spend their careers in closed networks; networks of people who already know each other,” therefore there is a level of trust, understanding, and common ground that exists among the group – it’s easy and comfortable. An open network is one where you’re meeting and introducing new people to add to your network, rather than sticking with the same, safe crew.

Constantly interacting with the same people with the same ideas doesn’t do much for expanding your network or exposing you to new opportunities and challenges – it’s just the same thing over and over again, rinse and repeat. On the other hand, by stepping out of your comfort zone and opening up your network, you’re opening yourself up to new experiences, new people, new ideas, new challenges, and new opportunities.

3. Learn to be a leader, not a follower.

Regardless of whether or not you wish to end up in a leadership position down the line, it’s important to think, act, and respond like a true leader. A huge part of being an effective leader is having the ability to inspire and influence others to achieve a common goal, together. Career success should be viewed the same way: as a joint effort, not a lone journey to the top.

Think about the impact leaders and influencers have had on your career so far. They’ve provided articles, books, seminars, and podcasts divulging the secrets to their success so that others may experience the same triumph for themselves. Therefore, don’t be stingy, greedy, or egocentric as you try to climb the ladder, because you never know whom you’ll meet again at the top. In the wise words of Francis of Assisi, “For it is in giving that we receive.”

July 2016 Newsletter for Accounting Professionals

Industry News and Updates:

I thought I would do something a little different this month. I am a huge proponent of certifications. The CPA (www.aicpa.org) has become the most important certification an Accountant can get! But what other certifications are out there????

Here is a brief list of the most popular ones I have seen:

- CMA – Certified Management Accountant imanet.org

- CFE – Certified Fraud Examiner acfe.com/

- CIA – Certified Internal Auditor https://na.theiia.org/

- CISA – Certified Information Security Manager http://www.isaca.org/certification/cism-certified-information-security-manager/

- CTP – Certified Treasury Professional ctpcert.afponline.org

- CPP – Certified Payroll Professional americanpayroll.org

- CFP – Certified Financial Planner – cfp.net

- AVA – Accredited Valuation Analyst – nacva.com

- CFFA – Certified Forensic Financial Analyst http://www.nacva.com/certifications/

- CRP – Certified Risk Professional bai.org

- EA – Enrolled Agent naea.org

- CA – Chartered Accountant cica.ca

- CFA – Chartered Financial Analyst cfainstitute.org

- Certified Bookkeeper aipb.org

And there are many more! Here is another resource: http://www.newaccountantusa.com/newsfeat/ip/ip_profcerts.html

See you again in September 2016!

Local Statistics:

- National Unemployment Rate (June): 4.9 (last year 5.3)

- Houston Unemployment Rate (June): 5.5 (last year 4.4)

- Labor Participation Rate: 62.7% (last year 62.60%) – All time high January 2000: 67.30%

- Manufacturing Index: 45.8 (last year 46.1) – from what I have read 50 is the magic number!

- Oil Rig Count: 417 (last year 861)

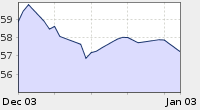

- Price of Oil: 41.14 (last year around 59)

- Industries hiring: Consumer Products / Service related companies, Construction, Real Estate, Non Profit, Public Accounting Firms!!!!

- Positions in demand: Staff & Senior Accountants, Tax, Audit,

Interesting Articles:

- What NOT to say to a hiring manager: http://wp.me/puDjI-1kE

- 8 things to remember before and after you step foot in the lobby for an interview: http://wp.me/puDjI-1lX

- Did you know: 5 tips when updating your resume: http://wp.me/puDjI-1fg

- Interview Preparation Checklist: https://dianedelgadolemaire.com/short-interview-preparation-checklist/

Current list of openings:

Galleria area:

- Bookkeeper / Office Manager to 65K

- Associate Manager / Manager – Professional Services Firm – Consulting on high profile projects – full time role – need at least 2.5 year of public accounting and maybe a splash of industry to qualify

- Senior Federal & State Tax Accountant

- Senior Internal Auditor – low travel

- Reduced work week hours: Tax Manager or Supervisor – small public accounting firm

- Treasury / Credit Manager

- Non Profit Senior Auditor

- Tax Staff Accountant

- Tax Senior Accountant – High Net Wealth

- Staff Auditor – Public Accounting

- Senior Auditor – Public Accounting

- Shared Services Controller

North Houston:

- Senior Accountant – NW Houston

- Senior Insurance Accountant – NW Houston

- Staff Accountant – NW Houston

- Accounting Manager – Real Estate – Woodlands

- Payroll Administrator

- AP Specialist

- AR Specialist

- SEC Senior Accountant

- Staff Auditor

- Controller, CPA – 100K

Downtown/Central:

- Senior Auditor, Downtown, 40% travel

- Property Accountant – Lead

- Property Accountant Staff

- Senior IT Auditor – Galleria

- International Accounting Manager

- Treasury Analyst, DT, Must have Big 4 Audit

- Billing Specialist with Elite

- SEC Reporting Manger

- SEC Senior Accountant

Southwest Houston/Energy Corridor:

- AP Manager

- Audit Senior – 60% travel

- Senior Accounting Analyst – Special Projects

- Staff Job Cost Accountant

- Compensation Analyst

Consulting & Temporary Roles:

- Bilingual Staff Accountant

- Intercompany & FX Senior Accountant

- 4 Fixed Asset Accountant – West

- Senior Staff Accountant – Woodlands

- Bilingual Timekeeper – Woodlands

- AP Clerk – Galleria

- IT Auditor – ITGC – North

- Payroll Manager – Ceridian / Ulti Pro

www.linkedin.com/in/dianedelgadolemaire/

www.facebook.com/CPARecruiterHouCFS

1.32 3.23%

1.32 3.23%